2026 Outlook Series Part 1 - The Shifting Core of Life Sciences and Healthcare M&A: Value, Focus, and Fundamentals

- Sebastian Andersen

- Dec 10, 2025

- 6 min read

A ClarityNorth Partners 2026 Outlook Series - Part I

As we enter 2026, one theme is unmistakable across life sciences dealmaking: the fundamentals are shifting.

At ClarityNorth Partners, we have spent the past year working with clients who are navigating an M&A environment that looks markedly different from the exuberant years before the correction. Valuations are tighter, competition is sharper, and strategic discipline has returned to the center of every deal conversation.

Question is whether this will continue in 2026.

This article marks the first of two in our 2026 forward-looking series.

Here, we focus on the shifting core of life sciences and healthcare M&A: how deal value, focus, and fundamentals are being redefined across the sector. In Part II, we will turn outward to the broader realities shaping M&A overall, from regulation and capacity to sustainability and geopolitics. Life sciences and healthcare are intertwined with various sectors across the world, and understanding these dynamics and their impact is equally important.

What’s Currently Top-of-Mind for Life Sciences and Healthcare Leaders?

Across the globe, life science executives are optimistic about the outlook of 2026. However, this optimism differs from region to region, with U.S. biopharma and medtech leaders being the least optimistic about the year to come. The positivity is tempered by persistent regulatory and policy shifts, shifts in digitalization, competitive pressure, macro and supply chain volatility, and changes in care delivery and models.

All these factors have a direct impact on how life sciences and healthcare dealmaking will look in 2026. We believe the impact will be most noticeable across value creation, M&A integration, AI and digital, multiples and capital discipline, deal structuring, and how we will continue to see a return to fundamentals.

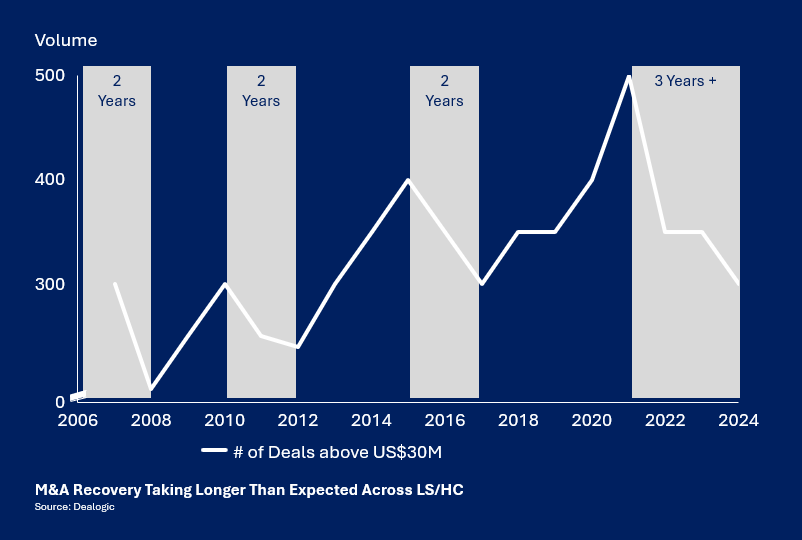

The good news? We do in general expect an increased number of deals and higher aggregate deal value, but the discipline and selectivity seen throughout 2025 will persist. The era of indiscriminate optionality is over.

The Narrowing Lens of Value Creation

In earlier years, many acquirers sought breadth over depth. Platform acquisitions promised diversified pipelines yet often stretched integration capacity and diluted focus. That dynamic is shifting again.

Deal activity increased through the second half of 2025, and 2026 is expected to continue that momentum, with buyers showing renewed interest in both later-stage assets and select early-stage programs that strengthen core portfolios. Pipeline expansion is back on the agenda, but investors still expect a clear path to value and disciplined capital allocation.

The narrowing lens of value creation remains intact, but it is no longer limited to later-stage assets. Buyers are prioritizing programs that fit within defined therapeutic, technological, or operational theses and that can generate measurable progress within tight time horizons. Early-stage assets are attractive again when they reinforce strategic direction, not when they simply broaden optionality.

Companies are acting more like portfolio managers, adding assets that enhance the depth and quality of their core rather than stretching into unrelated areas. Certainty remains essential, but certainty is now defined by strategic coherence, not just asset maturity. 2026 will continue to be shaped by these trends.

Integration as Strategy

In 2026, integration is not simply a post-deal requirement. It shapes which deals are pursued in the first place. Buyers are evaluating operational fit, cultural alignment, digital maturity, and regulatory compatibility before they advance to formal negotiations. This shift reflects lessons learned over the past two years, where many companies struggled to capture value from acquisitions due to fragmented systems and limited readiness.

The increased deal flow expected in 2026 does not change the need for integration discipline. If anything, it raises the bar. Companies are building integration plans earlier, engaging cross-functional leaders sooner, and modeling operational execution before committing to a transaction. Firms that treat integration as a central design element and not an afterthought complete deals faster and extract value more reliably.

This approach is particularly visible among mid-cap acquirers that rely on precision and preparedness to compete with larger players. As deal volumes rise, integration quality will increasingly determine which acquirers outperform the market.

The Digital and Analytical Shift

Artificial intelligence is often described as a tool that enhances innovation, yet in 2026 it is increasingly becoming the very substance of what companies seek through M&A. AI platforms, digital operating systems, and data-rich infrastructures now shape how acquirers evaluate strategic fit and long-term competitiveness.

Companies are actively targeting platforms that automate administrative workflows, unify data across functions, and create operational leverage that traditional assets cannot match. With AI adoption accelerating across the industry, many of the most attractive targets in 2026 are those with embedded digital infrastructure and proven automation value.

AI is also redefining what constitutes competitive advantage. Acquirers are no longer focused solely on acquiring scientific assets or physical capacity; they are pursuing data engines, workflow automation platforms, and analytical ecosystems that can reduce administrative friction, accelerate decision-making, and improve patient and provider engagement.

Increased deal activity in AI-enabled healthtech illustrates this shift, with buyers prioritizing companies that integrate automation, data interoperability, and scalable digital capabilities into their operating models. The deal narrative now centers on owning the digital backbone that will shape future efficiency, innovation velocity, and regulatory responsiveness, making AI capabilities central to value creation rather than peripheral to it.

A New Discipline Around Multiples

Valuation discipline remains a defining feature of today’s market, even as appetite for acquisitions grows. Buyers are willing to pay for high-quality science or differentiated technology, but they expect evidence.

Multiples are being justified through data, not sentiment, and companies must demonstrate credible milestones, realistic timelines, and operational readiness. While early-stage assets are back in focus for some acquirers, the days of paying steep premiums for unproven programs are not returning.

The correction of the past two years has reset expectations across the industry. Stronger balance sheets and increased liquidity among disciplined acquirers give them an advantage, but that advantage is expressed through selectivity, not aggressiveness. Buyers are comparing scientific differentiation, capital efficiency, and regulatory feasibility more rigorously than before.

As a result, multiple expansion is likely to be reserved for assets that clearly advance a strategic priority or strengthen a competitive position, while broader market valuations remain grounded in fundamentals.

Creative Deal Structures

Deal structuring is becoming more flexible as companies balance renewed acquisition interest with the need to manage financial exposure. Earnouts, option-based partnerships, staged equity investments, and milestone-linked payments are increasingly common across both biopharma and medtech. These models allow buyers to pursue earlier-stage assets without committing full value upfront and give sellers continued participation in long-term upside.

This shift reflects practical needs rather than experimentation. Not all companies can or should finance acquisitions with large cash components, especially in a higher-cost-of-capital environment. Flexible deal structures also reduce pressure on valuation alignment, which remains one of the largest obstacles to deal completion.

The growing use of co-development agreements and hybrid partnership models in 2025 is likely to continue into 2026, enabling companies to access innovation while managing risk. For sellers, these structures create more pathways to capital and collaboration, even when traditional M&A valuations are difficult to justify.

The Return to Fundamentals

What ties these trends together is a return to fundamentals. In 2026, the conversation is less about deal count and more about deal quality. Fewer transactions are being completed, but each one is larger, better structured, and more strategically aligned. Successful acquirers have learned that sustainable growth requires discipline, clarity, and preparedness long before a transaction enters the market.

For ClarityNorth Partners, this evolution aligns directly with our mission. We believe that M&A works best when science, strategy, and structure align. The coming year will reward those who can combine a clear thesis with operational readiness and post-deal execution. It is not the largest firms that will lead this next phase of consolidation, but the most disciplined and deliberate ones.

Looking ahead, we expect the story of 2026 to be defined by precision. Deal activity will tick upwards and will remain stronger in outcome. The emphasis will remain on scalable science, operational compatibility, and integration excellence across digital and science.

That is the shifting core of M&A in life sciences and healthcare.

Methodology

This outlook draws on a combination of quantitative market data, industry reports, and ClarityNorth Partners’ direct advisory experience. We reviewed analyses from leading professional services firms, investment banks, and sector-specific data providers to understand 2025 market performance and early 2026 signals. These insights were supplemented by CNP’s internal knowledge base and a series of focused interviews and conversations with executives and investors across biopharma, medtech, and healthcare. Together, these inputs form the foundation for our forward view of life sciences and healthcare M&A in 2026.

Disclaimer:The information provided in this article is for general informational purposes only and does not constitute legal, financial, or professional advice. ClarityNorth Partners makes no representations or warranties of any kind regarding the accuracy, completeness, or suitability of the information. Readers should consult with their advisors before making any business decisions based on this content.

© ClarityNorth Partners 2025. All rights reserved

Comments